Navigating the Global Arena: Resilience, Strategy, and the Future of Chinese Entrepreneurs Amidst Shifting Trade Dynamics

Analyzing Chinese entrepreneurs' global expansion, this report covers supply chain strengths, cultural resilience, and navigating geopolitical/tariff challenges.

Click HERE to read Chinese version.

I. Introduction: The Resilient Rise of Chinese Global Entrepreneurs

A. Setting the Stage: China's Entrepreneurs in the Global Arena

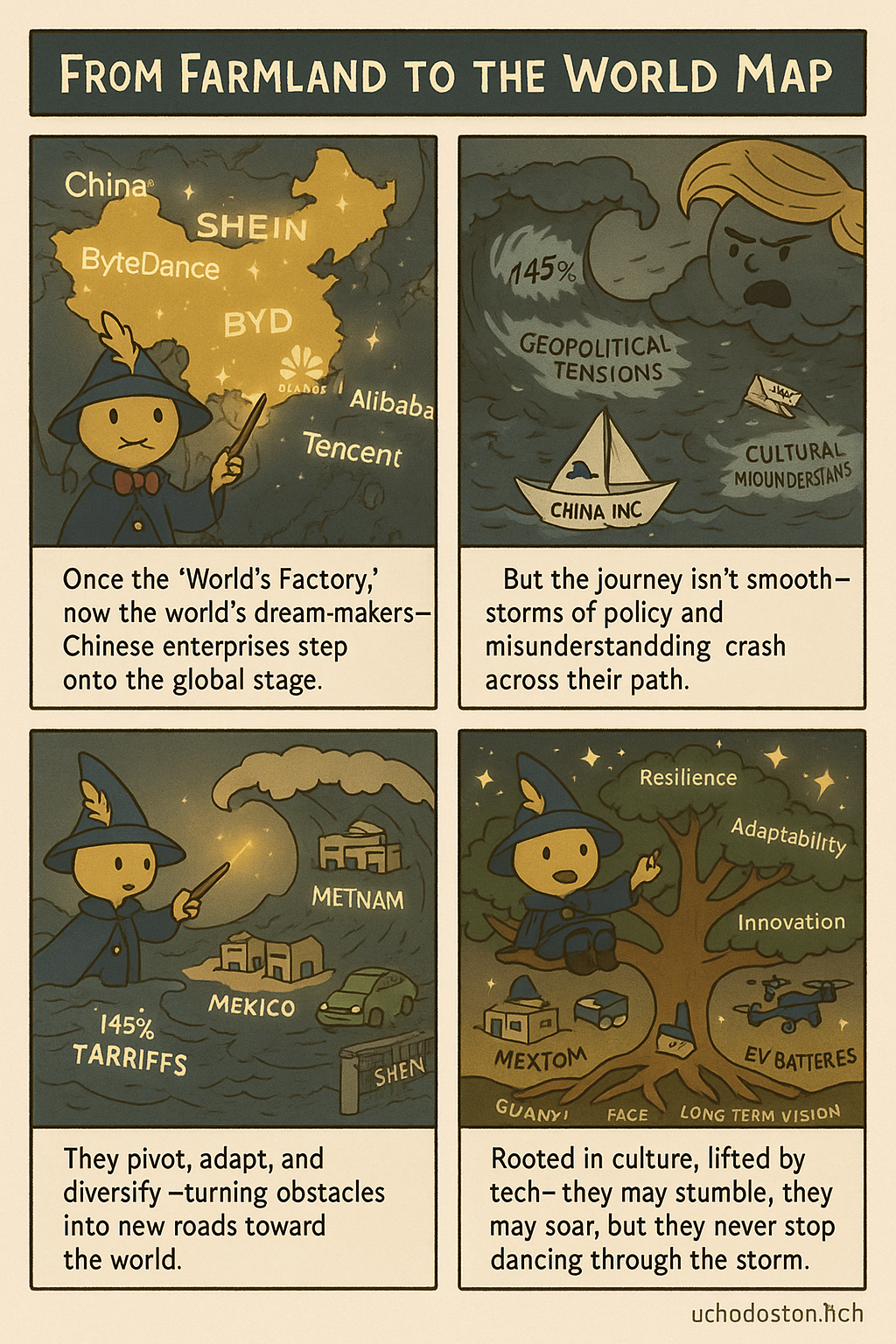

The global business landscape has witnessed a transformative phenomenon in recent decades: the rise of Chinese entrepreneurs venturing beyond their vast domestic market to establish significant international footprints. Companies such as ByteDance (TikTok), Shein, BYD, Huawei, Alibaba, and Tencent have evolved from domestic players to global household names, reshaping industries from e-commerce and digital payments to social media, gaming, and advanced manufacturing.1 This expansion is not merely an economic footnote; it represents a fundamental shift in global commerce, contributing significantly to wealth creation and intensifying market competition worldwide.4 This outward push builds upon China's remarkable economic transition, where entrepreneurship played a pivotal role in transforming the nation into the "world's factory" through decades of export-oriented growth.4 Chinese entrepreneurs have progressed from primarily exporting "made-in-China" goods to engaging in sophisticated global strategies, including cross-border mergers and acquisitions and establishing international operations.4

B. Navigating Complexity: Supply Chains, Culture, and Geopolitics

The journey of Chinese entrepreneurs onto the global stage is underpinned by distinct advantages but also fraught with significant challenges. Central to their competitive edge is China's unparalleled supply chain ecosystem, which has evolved far beyond low-cost labor to encompass sophisticated manufacturing capabilities, extensive infrastructure, and deep integration into regional and global networks.6 Equally important is the unique character of Chinese entrepreneurship itself, often characterized by remarkable resilience, flexibility, diligence, and efficiency, traits deeply rooted in the nation's cultural fabric.11 However, this global expansion unfolds against a backdrop of increasing geopolitical volatility and complexity, most notably the fluctuating dynamics of US-China relations and the imposition of stringent trade policies, such as the significant tariff escalations enacted after April 2nd, 2025.15 Navigating this intricate web of opportunities and obstacles demands exceptional adaptability, a defining characteristic observed in the strategic responses of many Chinese firms facing international headwinds.14

C. Report Roadmap: Key Areas of Exploration

This report provides an in-depth analysis of the multifaceted journey of Chinese entrepreneurs operating globally. It begins by examining the foundational pillars of their competitiveness: the strengths of China's supply chain and the cultural and characteristic attributes of its entrepreneurs. It then delves into case studies of both successful and failed global ventures, extracting critical lessons learned. A significant portion of the analysis is dedicated to dissecting the impact of the recent US tariff regime implemented after April 2nd, 2025, and detailing the adaptive strategies Chinese firms are employing to navigate this challenging new environment. Finally, the report synthesizes these findings to offer strategic considerations for sustained global success in an era defined by economic shifts and geopolitical uncertainty.

II. Foundations of Global Competitiveness: Supply Chains and the Chinese Entrepreneurial Engine

A. The China Advantage: Deconstructing Supply Chain Strengths

China's position as a global manufacturing leader is built upon a foundation that extends far beyond its historical advantage of low labor costs. Over decades, strategic policy direction and massive investment have cultivated a sophisticated and deeply integrated manufacturing ecosystem, making China a linchpin in numerous global value chains.6

- Beyond Low Cost: The Ecosystem Edge: China's competitiveness today stems significantly from policy-driven investments in human capital, technological innovation, infrastructure, and automation.9 This includes the cultivation of a vast pool of well-educated engineers; China produced 4.7 million engineers in 2022, more than the U.S., India, and Europe combined.48 While work-life balance is a growing concern, the tech sector, in particular, has been known for demanding work schedules (like the "996" model) aimed at driving rapid innovation and meeting intense competition.49 Total R&D spending reached an impressive USD 660 billion in 2021, second globally only to the US, with a strong focus on tech-intensive sectors like computers, communications, electronics, machinery, and automobiles.9 This R&D push is complemented by substantial investments in physical and digital infrastructure, including advanced telecommunications networks, data centers, sprawling industrial parks, efficient logistics networks, and a massive deployment of industrial robots – by 2021, China had installed more than the rest of the world combined.9 This integrated system of innovation, infrastructure, and a developed talent pool creates significant efficiencies and cost-effective production processes.9 The very complexity and interconnectedness of this ecosystem—encompassing R&D, skilled labor, automation, component suppliers, and logistics—creates a "stickiness".8 While rising costs and geopolitical pressures incentivize diversification, replicating this highly optimized environment at scale, particularly for complex industries like electronics, proves difficult and costly for competitors in the short-to-medium term, making swift relocation challenging for many firms.8

- Scale, Agglomeration, and Integration: China benefits immensely from economies of scale, derived from its large population (human resources) and land availability.6 Furthermore, the spatial agglomeration of industries, suppliers, workers, and consumers in major manufacturing hubs like the Pearl River Delta and Yangtze River Delta lowers transportation costs, creates vast local markets and labor pools, and facilitates knowledge spillovers.6 China is also deeply integrated into complex Asian supply chains, often involving goods-in-process crossing borders multiple times, which allows it to efficiently transmit production capabilities globally.6

- Sector-Specific Dominance: China's supply chain prowess manifests differently across industries:

- Apparel: Despite rising labor costs and US policy actions (tariffs, UFLPA), China maintains dominance through its vast control over textile inputs (yarns, fabrics) and the efficiency and skill of its workforce, often operating within fully domestic value chains from fiber to finished garment.8

- Consumer Electronics: This is where China's global production and export shares are highest. For over 15 years, it has exported more laptops, tablets, and mobile phones combined than the rest of the world.8 Its dominance extends to critical components like PCBs, memory chips, and transistors, backed by an ecosystem difficult to replicate elsewhere.8

- Solar PV: Driven by significant state support and a massive domestic market, Chinese firms possess a formidable price and technical advantage across most of the solar value chain, from polysilicon to finished modules.8 Its global share in intermediate goods for panels continues to increase.8

- Automotive/EV: China leverages its huge internal market, an early lead in EVs, and dominance in key components (tires, brakes, EV batteries) to be a major global exporter.8 Control over the processing of critical minerals (primary global producer of 29 types) provides resilience, especially for the EV supply chain.10 Subsidies and technical efficiencies maintain cost competitiveness despite trade barriers.8

- Resilience and Price-Making Power: China's relatively stable production environment offers a reliable fallback compared to more volatile emerging markets, as demonstrated when crises hit alternative locations.8 Its dominance allows it to act as a global price maker in many industries. This presents a dynamic risk for diversification efforts: China could potentially leverage overcapacity or price reductions to regain market share lost to competitors, especially if instability arises in alternative production hubs.8 State-owned enterprises (SOEs) also play a pivotal role in economic stability and supply chain operations.10

Table 1: China's Supply Chain Strengths and Diversification Trends by Sector

| Sector | Key Retained Advantages in China | Key Diversification Trends |

| Apparel | Dominance in inputs (textiles, yarn); Production efficiency & skills offset costs; Integrated domestic value chains; E-commerce | Cost-driven shift to South Asia (India, Bangladesh), SE Asia (Vietnam, Cambodia), MENA; US policy influence (tariffs, UFLPA); Developing input capacity elsewhere (India, Turkey, Vietnam) |

| Consumer Electronics | Highest global production/export share (laptops, phones); Dominance in components (PCBs, memory); Highly optimized ecosystem | Emergence of final assembly hubs (Vietnam, India); Specialized component production in SE Asia (Malaysia, Singapore); FDI shifts; Potential expansion to laptops in Vietnam/India |

| Solar PV | Dominant & increasing role (polysilicon to modules); Price & technical advantage (state support, domestic market); Input leadership | Splintering of final assembly (SE Asia for US market); Developing ASEAN supply chains (still reliant on China); Alternative input producers (Malaysia, Vietnam); Potential India/Turkey growth |

| Automotive/EV | Massive domestic market; EV first-mover advantage; Component dominance (tires, brakes, batteries); Critical mineral control; Cost competitive | Policy pushback (US/EU tariffs, rules); Regionalization (Mexico, CEE); US reshoring efforts; Potential bifurcation (China vs. ex-China); Growth in China-to-EM exports |

Data Sources: 8

B. The Entrepreneurial DNA: Cultural Roots and Defining Traits

Beyond the tangible assets of its supply chains, the success of Chinese entrepreneurs on the global stage is deeply intertwined with a unique set of cultural values and characteristic traits that shape their approach to business.

- Cultural Foundations: Chinese business practices are profoundly influenced by centuries-old cultural norms, particularly those derived from Confucianism.12 Understanding these is crucial:

- Guanxi (关系): More than mere networking, Guanxi refers to the cultivation of deep, complex, reciprocal interpersonal relationships and networks.26 Rooted in Confucian ideals of relational duties and obligations 26, Guanxi serves as a vital mechanism for building trust, facilitating business dealings, accessing resources, and navigating complex or weakly institutionalized environments.26 Building Guanxi requires time, sincerity, and consistent interaction, often involving social activities like dinners and banquets.26 While powerful, reliance on Guanxi also carries inherent risks and requires careful management.50

- Mianzi (面子 - Face): This concept relates to social standing, reputation, prestige, and the importance of avoiding embarrassment or conflict in social and business interactions.12 Maintaining face for oneself and one's counterparts is essential for smooth relationships and successful negotiations.12

- Long-Term Orientation (LTO): Chinese culture scores exceptionally high on this dimension, indicating a societal focus on the future, perseverance, thrift, and the importance of building enduring relationships.30 This contrasts sharply with more short-term oriented cultures.30 LTO influences strategic planning, investment in innovation even under pressure, and a focus on sustainable development.14 It is considered a key factor in the economic rise of East Asian nations.31

- Interpersonal Relatedness (IR): Identified as a core "Confucian personality" trait unique to Chinese culture, IR involves a strong orientation towards instrumental relationships, adherence to social hierarchies and norms, conflict avoidance, and maintaining harmony.12 It directly taps into the values underpinning Guanxi, Renqing (reciprocity), and Mianzi.12 Research suggests that moderate levels of IR are associated with higher entrepreneurial income in China, potentially reflecting a balance between leveraging social networks and embracing necessary risk-taking.13 However, very high IR might negatively correlate with innovation due to risk aversion and adherence to tradition.13

- Collectivism: Chinese society emphasizes interdependence and group harmony over individual autonomy.14 Business decisions often consider collective benefit, and strong loyalty exists within in-groups, particularly the family.14

- Characteristic Traits: These cultural underpinnings foster specific entrepreneurial traits:

- Resilience and Adaptability: A hallmark of Chinese entrepreneurs is their ability to navigate ambiguity, adapt to rapid changes in policy and market conditions, and persevere through challenges.22 This may be linked culturally to a lower score on uncertainty avoidance, suggesting a greater tolerance for ambiguity and flexibility.14

- Diligence, Hard Work, and Efficiency: A strong achievement drive, eagerness to learn and utilize skills, and a focus on efficiency are commonly observed.11 Confucian ideals encouraging continuous self-improvement may contribute to this work ethic.11 The demanding "996" work culture observed in some tech sectors, while controversial, reflects an intense drive for rapid growth and innovation.49

- Family Influence: The family unit plays a crucial and often central role, providing essential start-up capital, affordable labor, and a critical support network for establishing and growing businesses.11 A large family can be a significant entrepreneurial asset.11

- Patriotism and Integrity: These values are sometimes cited as aligning well with the domestic business environment and contributing to enterprise development.51

- Entrepreneurial Trends (GEM Data): Data from the Global Entrepreneurship Monitor (GEM) project (2002-2018) provides empirical context 4:

- Entrepreneurship is highly valued socially (good career choice, high status).

- Early-stage entrepreneurial activity (TEA) rates were high initially (ranked 7th globally 2002-2011) but declined significantly after 2015, falling below the global average (ranked 25th in 2018).

- Opportunity-motivated entrepreneurship dominates, but expectations for high job creation have decreased.

- Female entrepreneurship rates are relatively high compared to international counterparts, though also showing recent declines.

- Corporate entrepreneurship (EEA) rates are very low.

- Framework conditions are strong in infrastructure but only moderate in other areas (social, cultural, political, economic).

The interplay of these cultural factors and characteristic traits forms a complex picture. Elements like Guanxi, LTO, and family support act as strategic tools, enhancing resource mobilization, risk mitigation, and long-term persistence, thereby bolstering resilience.11 Entrepreneurs leverage these culturally embedded mechanisms to navigate challenges. However, these same factors can present limitations; for instance, over-reliance on Guanxi can be risky 50, and high IR might stifle innovation.13 Culture, therefore, functions as a potent, yet double-edged, strategic asset. Furthermore, the observed decline in start-up activity (TEA rates) since 2015, despite the high societal value placed on entrepreneurship, presents a paradox.4 While the idea of entrepreneurship remains highly respected, the practice may be encountering increased friction—perhaps due to market saturation, heightened competition, regulatory complexities, or a growing fear of failure in a maturing economy—compared to the initial decades of reform and opening up.4

Table 2: Key Characteristics and Trends of Chinese Entrepreneurship (GEM Data 2002-2018)

| Characteristic | Key Finding/Trend | Supporting GEM Data/Rank (Example) |

| Societal Value | Consistently high societal value; seen as good career choice; entrepreneurs respected. | 69% view as good career; 74% believe entrepreneurs have high status |

| Early-Stage Activity (TEA Rate) | High rates 2002-11, significant decline post-2015, falling below global average. | Ranked 7th globally (2002-11); Ranked 25th globally (2018) |

| Established Business Ownership | Peaked in 2009, sharp downward trend since. | 17.2% (2009) -> 3.2% (2018) |

| Motivation | Opportunity-motivated dominates over necessity-motivated since 2009. | - |

| Innovation Level | Consistent improvement 2011-2018 (new products/few competitors). | - |

| Growth Expectations | Declining levels of high-growth entrepreneurship (job creation). | 35% (2015) -> 20.8% (2018) |

| Female Entrepreneurship | Relatively high participation compared to global peers; proportionately as opportunity-motivated as men. | Ratio female/male TEA consistently higher. |

| Corporate Entrepreneurship (EEA) | Consistently low rates, significantly below global average. | Avg 1.15% (2011-18); 1.0% vs 3.85% global avg (2018) |

| Entrepreneurial Framework Conditions | Strong in physical infrastructure, services, internal market dynamics; moderate in all other aspects (score <3/5). | - |

Data Sources: 4

III. Charting Global Waters: Triumphs, Setbacks, and Lessons Learned

The global expansion of Chinese enterprises presents a rich tapestry of both remarkable successes and cautionary failures. Analyzing these experiences reveals critical factors that determine outcomes in diverse international markets.

A. Case Studies in Success: Strategies and Execution

Several Chinese companies have achieved significant global prominence by effectively leveraging their strengths and adapting their strategies.

- Tech & E-commerce Ascendancy:

- ByteDance (TikTok): A prime example of product-led global success, TikTok rapidly became a dominant force in the global social media landscape, demonstrating an exceptional ability to capture user interest across diverse cultures.1 Its success highlights the power of innovative product design and user experience in achieving global scale.1

- Shein: This ultra-fast fashion retailer initially achieved explosive growth by mastering supply chain efficiency, utilizing a direct-to-consumer model that leveraged China's manufacturing base and exploited the US 'de minimis' tariff loophole for low-value shipments.35 Its agility in responding to fashion trends and aggressive pricing conquered significant market share in developed countries.3 However, its model has also attracted scrutiny regarding labor practices and sustainability.52

- Alibaba & Tencent: These tech giants became global household names primarily through dominance in e-commerce, digital payments, social media, and gaming.1 While their initial focus might have been more regional 2, their influence and investments now span the globe.

- Manufacturing & Hardware Champions:

- BYD: Build Your Dreams (BYD) has rapidly ascended to challenge and even surpass Tesla in global EV sales.46 Its strategy combines deep vertical integration (controlling battery and semiconductor production), aggressive pricing to capture mass markets, continuous technological innovation (like its Blade Battery and fast-charging capabilities), and a determined global expansion focused on local assembly in key regions (Europe, Latin America, SE Asia, Middle East) to mitigate tariff risks and access new consumers.46 This expansion faces geopolitical hurdles, particularly in markets like the US and India 55, but demonstrates a clear ambition for global leadership, even extending to controlling its own logistics with massive car carrier ships.53

- Huawei: Despite facing severe US sanctions targeting its access to technology and markets 56, Huawei has shown extraordinary resilience.24 Its survival strategy involves diversifying its supply chain away from US components ("Delete America" approach 57), intensifying domestic R&D investment, developing its proprietary HarmonyOS, forming strategic partnerships (e.g., in AI 23), expanding into new business areas like cloud computing and EV software, and leveraging strong state support and the domestic market.23 It maintains a leading position in 5G technology globally despite restrictions.25 Its earlier strategy involved penetrating rural markets before tackling urban centers.2

- Lenovo: A prominent example of successful internationalization achieved largely through strategic acquisitions, notably IBM's PC and server businesses and Motorola's handset division.2 These acquisitions provided immediate global presence, brand recognition, and international management expertise.2 Lenovo's strategy evolved through trial-and-error, emphasizing product excellence in its marketing rather than relying heavily on brand image campaigns.58 It stands as a globally recognized Chinese brand in the tech sector.3

- Haier: This appliance giant pursued an unconventional early internationalization strategy, targeting challenging developed markets like the US and Europe first, often as a niche player, before expanding into neighboring Asian countries.45 Key elements of its success include a relentless focus on improving product quality (initially through partnerships with foreign firms like Liebherr 2), building a global brand, strategic acquisitions (like GE Appliances 62), and adapting to local customer needs.3 Haier faced early hurdles with poor reputation but overcame them through strong leadership and a culture focused on innovation and customer responsiveness.61

- Tecno Mobile (Transsion Holdings): Little known in China, Tecno became a dominant mobile phone player in Africa by deeply understanding the local market and tailoring products accordingly.63 Its "glocal" strategy involved offering affordable, high-quality phones with features specifically desired by African consumers, such as multiple SIM card slots, long battery life, enhanced camera calibration for darker skin tones, and keyboards supporting local languages like Amharic, Swahili, and Hausa.63 Tecno utilized a multi-brand approach (Tecno, iTel, Infinix) targeting different price points and established robust distribution networks covering both urban and rural areas, coupled with extensive local advertising.67 After achieving success in Africa (48% market share in Q3 2023 67), Tecno expanded into other emerging markets in the Middle East, South Asia, Southeast Asia, and Latin America.63

- Niche Tech Leaders: Other Chinese companies have found global success by focusing on specific tech niches and product excellence. Examples include Anker Innovations (popular for portable chargers and accessories, focusing on quality, design, and packaging 59), DJI (dominant in the consumer drone market 52), and brands like Xiaomi, Oppo, and Vivo (known for competitive smartphones, particularly camera technology 3). Govee (smart lighting) is another example emerging from the Shenzhen tech ecosystem.69

- The Power of Localization: A common thread in many success stories is the commitment to deep localization – adapting not just language but products, services, marketing strategies, and even management practices to resonate with local cultures and meet specific market needs.38 Examples abound: KFC's China-specific menu items 37, IKEA offering assembly services and smaller furniture in China 71, Starbucks tailoring its menu 70, Puma's culturally relevant campaigns 37, and Haier's tailored branding.3 Effective localization involves understanding local digital ecosystems (like WeChat, Douyin, Xiaohongshu) 72, engaging local influencers (KOLs/KOCs) 37, and often empowering local management teams.73 Tecno's success in Africa is a prime example of deep product and marketing localization.63

- Evolving Strategies in Developed Markets (e.g., Japan): While direct market entry into highly developed and culturally distinct markets like Japan can be challenging, Chinese firms are adapting their strategies. Initially, acquisitions might have been resource-driven (e.g., acquiring technology or brands like Renown apparel 74). More recently, there's evidence of a shift towards market-driven acquisitions, such as Chinese firms buying Japanese hotels and recreational facilities specifically to serve the growing number of Chinese tourists visiting Japan.74 This indicates a more nuanced approach, leveraging acquisitions to tap into specific market segments rather than attempting broad, direct competition initially.

B. Analyzing Failures: Why Some Ventures Stumble

Despite the successes, numerous international ventures by both foreign companies in China and Chinese companies abroad have encountered significant difficulties or outright failure.

- Market Entry Missteps and Cultural Disconnects: Many failures stem from an inadequate understanding of or adaptation to the local market environment:

- Foreign Firms in China: Mattel's Barbie flagship store in Shanghai failed due to flawed assumptions about brand recognition and consumer desires in China.40 Tesco struggled due to cultural mismatches in marketing (ineffective loyalty programs), poor site selection ignoring local shopping habits, an inability to adapt its UK management model, and supply chain weaknesses.41 Amazon's China exit is linked to a lack of deep localization and potentially slow, headquarters-controlled decision-making.43 Uber couldn't compete with Didi partly because it failed to tailor its service model, pricing, and partnerships to Chinese user and driver preferences, relying too heavily on its global brand.44 Airbnb faced cultural resistance to its core concept and couldn't build trust like local competitors.39 LinkedIn reportedly failed due to weak demand for its specific service category in China.43

- Chinese Firms Abroad: Uniqlo's initial UK setback was attributed to appointing local management whose conservative style clashed with the company's collaborative culture, highlighting the challenge of transmitting corporate ethos across borders.39

- Navigating Regulatory and Geopolitical Minefields: External factors frequently derail international expansion plans:

- The high failure rate cited for foreign firms entering China (48% withdrawing within two years) points to systemic difficulties beyond individual company errors.40

- Institutional distance – differences in political, economic, and cultural systems between home and host countries – significantly increases the probability of encountering difficulties during market entry attempts.75 Research indicates Chinese state-owned enterprises (SOEs) are more prone to such troubles than private firms, while strong Corporate Social Responsibility (CSR) reporting can mitigate failure risk.75

- Specific regulatory barriers (like India's investment approval requirements impacting BYD 55) and major geopolitical events (like US sanctions crippling Huawei's access to key technologies 56) can fundamentally alter a company's global prospects.

These failures underscore that effective localization goes far beyond surface-level adaptations like language translation or minor product tweaks.37 True success demands a systemic adaptation of the entire business model—product strategy, marketing channels, pricing, service delivery, supply chain management, and organizational structure—to align with local cultural norms, consumer behaviors, competitive dynamics, and regulatory realities.39 Assuming global brand appeal or transplanting a home-market model without deep cultural fluency is a frequent recipe for failure.38

However, it is also crucial to view these setbacks through a long-term lens. Initial failures, while often costly, can provide invaluable market intelligence and learning experiences.40 Companies like Mattel demonstrated the ability to absorb early losses, analyze mistakes, and recalibrate their strategy for sustained engagement.40 This capacity to learn from failure and adapt aligns with the cultural trait of long-term orientation prevalent among many Chinese enterprises, turning short-term stumbles into catalysts for long-run resilience and eventual success.14

Table 3: Comparative Analysis of Global Expansion Strategies: Success vs. Failure Factors

| Company Example | Key Success Factors | Key Failure Factors (or Challenges Faced) | Key Lesson/Observation |

| TikTok (ByteDance) | Innovative product, strong user engagement, rapid global adoption. | Geopolitical scrutiny, data privacy concerns, potential bans. | Product appeal can transcend cultural barriers, but geopolitical risk is high for data-centric platforms. |

| Shein | Supply chain efficiency (initially), rapid trend adaptation, aggressive pricing, effective digital marketing. | Labor/sustainability criticism | Hyper-efficient, low-cost models face increasing regulatory and ethical scrutiny; adaptability under pressure is key. |

| BYD | Vertical integration, cost leadership, tech innovation (batteries, EVs), aggressive local assembly strategy. | Geopolitical barriers (US, India) | Vertical integration provides resilience and cost advantages; local production is crucial for navigating tariffs. |

| Huawei | Tech leadership (5G), R&D investment, supply chain/market diversification, state support, resilience. | Severe US sanctions, loss of key suppliers/markets, national security concerns. | Extreme resilience possible through diversification, innovation, and domestic support, but geopolitical targeting can severely impact global reach. |

| Lenovo | Strategic acquisitions (IBM, Motorola), leveraging acquired assets/brand, focus on product excellence. | Integrating acquisitions, building unified global culture. | Acquisitions can fast-track internationalization but require effective integration; product focus can build trust. |

| Haier | Early/bold internationalization, focus on quality/brand, strategic acquisitions (GEA), localization. | Initial low brand recognition/quality issues | Targeting difficult markets early can build capability; long-term brand building and localization are vital. |

| Tecno Mobile | Deep localization (product features, marketing, language), multi-brand strategy, affordable pricing, strong distribution in Africa/emerging markets. | Counterfeit products, rising competition, economic slowdown in key markets. | Deep understanding and adaptation to specific emerging market needs can create dominant market share, even against global giants. |

| Mattel (China) | (Initial Failure) | Flawed assumptions on brand appeal/culture, wrong store format/pricing. | Deep cultural understanding is non-negotiable; don't assume global brand resonance translates directly. Failure can be a learning step. |

| Tesco (China) | (Failure) | Cultural misfit (marketing, site selection), unadapted management model, supply chain issues. | Holistic localization across operations, marketing, and management is essential; ignoring local habits is fatal. |

| Uber (China) | (Failure) | Poor localization of service/pricing, weak local partnerships, over-reliance on global brand vs. local competitor (DiDi). | Cannot impose a global model; must adapt to local competition, partnerships, and user needs. |

| Amazon (China) | (Failure) | Lack of deep localization, potentially slow decision-making. | Agility and local empowerment are critical in fast-moving markets like China's e-commerce sector. |

Data Sources: 1

IV. The New Geopolitical Reality: Adapting to the Post-April 2025 Tariff Landscape

The global operating environment for Chinese entrepreneurs underwent a significant transformation following the implementation of new US tariff policies after April 2nd, 2025. These measures represent a substantial escalation of trade tensions and necessitate profound strategic adjustments for companies reliant on international markets, particularly the US.

A. Understanding the Tariff Shock: Trump's Policies and Their Implications

The tariff regime introduced in early 2025 marked a sharp departure, characterized by broad application and rapidly escalating rates, especially against China.

- Timeline and Scope: Key actions included 79:

- February 4: Initial 10% tariff on all Chinese imports (and 25% on Canada/Mexico) via IEEPA authority. China retaliates.79

- March 4: US tariff on China doubled to 20%.79

- April 2: Announcement of a baseline 10% tariff on nearly all countries, plus higher "reciprocal" rates. For China, this meant an additional 34% on top of the existing 20%, totaling 54%.79 The de minimis exemption for small parcels from China was also targeted for removal/high duties.80

- April 9: Reciprocal rates hiked further. While paused for most countries negotiating deals, China, having retaliated, saw its reciprocal rate increase significantly, leading to a total estimated rate of 104%.16 De minimis duties were also increased sharply to 90% ad valorem or US$75/item.80

- April 10/11: Further escalation brought the total minimum tariff rate on Chinese goods to 145% (clarified as 125% reciprocal plus 20% fentanyl-related).79 Exemptions were later granted for some electronics.80 De minimis duties were raised again to 120% ad valorem or US$100/item (rising to $200 in June).80

- April 15: A White House fact sheet stated China faces up to a 245% tariff when including existing Section 301 tariffs on specific goods (ranging from 7.5% to 100%).83 Section 232 investigations into critical minerals were launched, potentially leading to further tariffs replacing reciprocal ones.83 The situation remained highly fluid, marked by back-and-forth threats, retaliations, and mixed messages regarding negotiations, creating significant uncertainty for businesses.15

- Stated Justifications: The administration cited various reasons for these actions, including countering retaliatory tariffs from China 83, addressing national security concerns (e.g., critical minerals, fentanyl crisis, telecom equipment risks) 83, leveling the playing field against perceived unfair trade practices or foreign tariffs 81, protecting domestic industries, and addressing intellectual property theft.84

- Economic Impact: The economic consequences were projected to be substantial and widespread:

- Global Growth: Estimated reduction in global GDP by 0.7% to 1% due to direct shocks and spillover effects.16

- US Economy: Projected reduction in US GDP by approximately 1% (including retaliation), significant fall in imports (estimated $800 billion or 23% in 2025), and a decrease in average after-tax household income (average tax increase of $1,243 per household in 2025).85

- Federal Revenue: While conventional estimates projected large revenue increases ($166.6 billion in 2025), the prohibitive rates on Chinese goods were expected to significantly reduce imports, thus limiting actual revenue collection from that source. Dynamic scoring, accounting for negative economic impacts, lowered overall revenue projections.85

- Consumer Prices: Tariffs were widely expected to lead to higher prices for consumers across a range of goods, potentially fueling inflation.15

- Business Sentiment: Increased uncertainty, potential for disrupted supply chains, and higher costs were anticipated to weigh on business confidence, potentially impacting investment and hiring decisions.15

Table 4: Summary of Key US Tariff Actions Against China (Post-April 2, 2025)

| Date Effective (Approx.) | Tariff Type / Action | Specific Rate(s) / Total Rate (Approx.) | Affected Goods/Scope | Stated Justification (if provided) |

| Feb 4, 2025 | Initial IEEPA Tariff | 10% | All Chinese imports | National emergency (immigration/drugs) |

| Mar 4, 2025 | Escalation of IEEPA Tariff | Increased to 20% total | All Chinese imports | |

| Apr 2, 2025 | "Reciprocal" Tariffs Announced | +34% (on top of 20%) = 54% total | All Chinese imports | Reciprocity against foreign tariffs |

| Apr 2, 2025 | De Minimis Rule Change Targeted | End exemption; Impose duties (e.g., 30% ad valorem or US$25/item specific duty from May 2) | Small parcels (direct-to-consumer) from China/HK | Closing loophole |

| Apr 9, 2025 | Reciprocal Tariff Escalation | +50% (on top of 54%) = 104% total (approx.) | All Chinese imports | Response to China's non-repeal of its tariffs |

| Apr 9, 2025 | De Minimis Duty Escalation | Increased to 90% ad valorem or US$75/item specific duty (rising further) | Small parcels from China/HK | |

| Apr 10/11, 2025 | Further Reciprocal/Fentanyl Tariff Clarification/Escalation | Total minimum rate clarified/raised to 145% (125% reciprocal + 20% fentanyl) | All Chinese imports (some electronics later exempted | Retaliation, Fentanyl crisis |

| Apr 15, 2025 | Cumulative Rate Mentioned / Section 232 Launch | Up to 245% (incl. Section 301); Sec 232 investigation on critical minerals | All imports / Specific goods (Sec 301) / Critical minerals | Retaliation, Fentanyl, Sec 301 reasons, National Security (Sec 232) |

Data Sources: 16

B. Strategic Responses: Building Resilience Amidst Uncertainty

Faced with this dramatically altered trade landscape, Chinese companies accelerated and intensified strategies aimed at mitigating risk and ensuring continued access to global markets.

- Supply Chain Reconfiguration: The most immediate and widespread response was the acceleration of supply chain diversification efforts, moving beyond the "China+1" concept towards more substantial regionalization and nearshoring.18 This involved:

- Shifting Production: Actively moving manufacturing or assembly operations out of China to countries with lower tariff exposure to the US and potentially lower labor costs.18 Key destinations included Vietnam, Mexico, India, Bangladesh, other ASEAN nations, and potentially Pakistan.18 Companies like Shein incentivized suppliers to relocate to Vietnam 36, while BYD established new assembly plants in multiple countries.46 Major brands like Nike, Apple, and Samsung had already been shifting production, a trend the tariffs intensified.88

- Diversifying Suppliers: Reducing reliance on single-source Chinese suppliers by identifying and cultivating alternatives in other regions.84

- Challenges: This reconfiguration is complex and costly.87 Replicating China's mature ecosystem efficiency elsewhere is difficult 18, and there's a risk that new production hubs could themselves become targets of future tariffs.89 Furthermore, China retains the ability to potentially claw back market share through competitive pricing or if stability falters in alternative locations.8

- Market Diversification: Recognizing the heightened risk and cost associated with the US market, companies strategically pivoted to reduce dependency and cultivate growth in other regions.22

- Focus Areas: Priority shifted towards Southeast Asia (ASEAN), countries participating in the Belt and Road Initiative (BRI), and the broader Global South (Africa, Latin America, Middle East), as well as Europe where feasible.22

- Rationale: These markets often present lower geopolitical friction, growing consumer demand, and existing frameworks for cooperation (like BRI and the Regional Comprehensive Economic Partnership - RCEP).22 China's trade with ASEAN and BRI nations saw significant growth, providing alternative outlets for exports.22

- Accelerating Technological Self-Reliance and High-Tech Research: The trade war and associated technology restrictions acted as a powerful catalyst for China's long-standing goal of reducing dependence on foreign, particularly US, technology.18 This involved increased investment in domestic R&D, nurturing local suppliers (the "Delete America" strategy 57), and prioritizing strategic sectors like semiconductors, AI, EVs, and advanced manufacturing, often supported by government initiatives like "Made in China 2025" and the "Dual Circulation Strategy".18 Huawei's development of HarmonyOS is a prime example of this drive.25

- Semiconductors: China has invested heavily (hundreds of billions of dollars 100) to build an indigenous semiconductor ecosystem, aiming for self-sufficiency.101 While still lagging global leaders like TSMC by several years in leading-edge logic chip manufacturing (e.g., 5 years behind 100) and advanced equipment 101, China has made significant strides. It leads in outsourced assembly, packaging, and testing (OSAT) with 38% global market share 104, holds 16% of the global fabless market 104, and is rapidly increasing capacity in legacy chip production (>28nm).101 China accounted for 55% of global semiconductor patent applications in 2021-2022 100, though its R&D intensity (7.6%) is lower than the US (18.8%).100 Despite export controls, China remains the largest single market for semiconductors, consuming 31-40% globally 102, and its imports of chip-making equipment surged in 2023.102

- Artificial Intelligence (AI): China has become a global leader in AI research publications, surpassing the US in volume.106 Chinese universities, particularly Tsinghua and Peking University, are major hubs for AI talent and research, contributing significantly to top AI conferences like NeurIPS, ICML, and ICLR.106 While the US still leads in translating research into notable models (e.g., foundation models) 107 and overall AI vibrancy 110, Chinese companies like DeepSeek, Zhipu AI, Baichuan AI, and Moonshot AI are rapidly closing the performance gap with leading US models.106 China ranks second globally in AI vibrancy, showing strength in R&D and infrastructure.110

- Mathematics and Fundamental Science: China has significantly increased its investment and output in fundamental research. R&D expenditure reached ~$500 billion in 2024 (2.68% of GDP).111 China now ranks first globally in the size of its research talent pool and number of STEM graduates (over 5 million annually).112 It has surpassed the EU in share of top 10% most cited publications and recently overtook the US in total number of scientific papers.113 Nine of the world's top 10 research institutions (by Nature Index) are now Chinese.111 While historically focused on application, there's growing emphasis on fundamental research, with notable contributions from Chinese mathematicians like Shiing-Shen Chern, Shing-Tung Yau, Chen Jingrun, and Yitang Zhang.115 China leads globally in research output in fields like chemistry, physical sciences, computer science, engineering, materials science, and mathematics.111

- Enhanced Localization and Regionalization: Navigating the fragmented global landscape requires moving beyond simple export models towards deeper localization and regionalized operations.73 This means establishing more autonomous regional hubs, adapting governance structures, forming local joint ventures and partnerships, and empowering local teams to make decisions tailored to specific market conditions.73 The traditional centralized, headquarters-dominated model becomes less effective in a decentralized world.73

- Leveraging Cultural Resilience: The inherent traits of Chinese entrepreneurship—adaptability, diligence, long-term orientation, and the strength derived from collective/family ties and Guanxi networks—provide a crucial foundation for weathering these geopolitical storms and executing complex strategic shifts.14 The ability to persevere through hardship and maintain a long-term perspective is a significant, culturally ingrained advantage.14

It becomes clear that the 2025 tariffs, while presenting significant barriers, primarily served to accelerate and intensify strategic shifts that were already underway due to evolving economic conditions (rising costs in China) and earlier rounds of trade friction.92 The tariffs forced a more rapid and decisive execution of diversification (both supply chain and market) and localization strategies, while reinforcing the national push for technological independence.18 Concurrently, the US-China tensions and tariff wars appear to be strengthening alternative economic spheres. Regional blocs like RCEP, encompassing China and ASEAN, have gained importance 48, and Chinese companies are visibly deepening their engagement with the Global South through initiatives like the BRI.22 This suggests a potential long-term reordering of global trade flows, moving away from a purely US-centric model towards a more multipolar or fragmented structure where China and emerging economies play increasingly central roles.19

C. In Focus: How Key Players are Adapting

The strategic responses are clearly visible in the actions of prominent Chinese companies operating globally:

- Shein: Facing the double blow of high tariffs and the closure of the de minimis loophole (which was crucial to its original model 35), Shein moved decisively to shift production, actively incentivizing its Chinese suppliers to establish operations in Vietnam.76 This aims to leverage Vietnam's lower costs and more favorable trade status with the US.36 Simultaneously, Shein invested in optimizing its global logistics to manage new compliance requirements and maintain delivery speeds.36 Market diversification beyond the US is also part of its strategy.36 These shifts occur amidst ongoing sustainability concerns and potential impacts on its IPO valuation and timeline.35 Price increases have been implemented, reflecting the new cost realities.86

- BYD: The EV giant explicitly frames its aggressive global manufacturing expansion—building factories in Hungary, Brazil, Thailand, Indonesia, Pakistan, and Mexico—as a strategy to mitigate tariff risks and gain closer access to key growth markets.46 By assembling vehicles locally, BYD aims to circumvent import duties that could render its competitively priced EVs unviable.46 This localization drive is coupled with a strong export push into Europe, Southeast Asia, Latin America, and the Middle East 54, consciously diversifying away from markets with high geopolitical barriers like the US and India.55 Its vertically integrated model provides crucial cost control and pricing flexibility in this volatile environment.54

- Huawei: Perhaps the most prominent example of resilience under geopolitical pressure, Huawei's adaptation involves a multi-pronged strategy: aggressively diversifying its supply chain to reduce US dependency, significantly increasing R&D spending to foster domestic innovation (including its HarmonyOS), expanding into new revenue streams (cloud, EV software), strengthening its position in the domestic market, cultivating partnerships (e.g., AI), and strategically expanding in emerging markets less affected by US sanctions.23 This demonstrates a shift towards survival and seizing opportunities wherever possible, supported by strong domestic backing.57

Table 5: Strategic Responses of Chinese Companies to Tariffs and Geopolitical Risk (Post-April 2025)

| Strategy | Description/Rationale | Target Regions/Markets (Examples) | Company Examples | Supporting References |

| Supply Chain Diversification | Shifting production/assembly out of China; Finding non-Chinese suppliers; Nearshoring/Friend-shoring to reduce tariff exposure & geopolitical risk. | Vietnam, Mexico, India, ASEAN, Pakistan, Bangladesh, CEE, MENA | Shein, BYD, Huawei, Apple, Samsung, Nike | |

| Market Diversification | Reducing reliance on US/Western markets; Expanding into emerging economies & regions with lower geopolitical friction and growing demand. | ASEAN, BRI Countries, Global South (Africa, LatAm, MidEast), Europe | BYD, Huawei, Shein, Tecno, Others | |

| Tech Self-Reliance & Innovation | Increasing domestic R&D; Developing proprietary technologies (OS, chips, AI); Reducing dependence on foreign tech inputs; Aligning with state initiatives; Leading in specific tech areas. | Primarily Domestic (China), Global R&D presence | Huawei, BYD, Alibaba, Tencent, AI startups, Semiconductor firms | |

| Enhanced Localization | Deeper adaptation to local markets (products, marketing, management); Establishing regional hubs; Local partnerships/JVs; Empowering local teams. | Specific target markets globally | Haier, Lenovo, BYD, Tecno, Others | |

| Leveraging Cultural Resilience | Utilizing LTO for patience/persistence; Using Guanxi networks carefully; Drawing strength from collective/family orientation; Adaptability. | Global Operations | General Characteristic |

Data Sources: Combined from relevant snippets listed in the outline and added snippets.

V. Future Trajectories: Strategies for Sustained Global Success

A. Synthesis: Key Drivers of Success and Failure in the New Era

The analysis reveals that navigating the complexities of the contemporary global market demands more than traditional business capabilities from Chinese entrepreneurs. Success hinges on a sophisticated interplay of factors. Robust supply chain management, evolving from cost efficiency to encompass resilience and diversification, remains fundamental.8 The inherent characteristics of Chinese entrepreneurship—particularly resilience, adaptability, diligence, and a long-term orientation rooted in cultural values—provide a crucial foundation for weathering shocks and pursuing ambitious goals.22 However, the case studies demonstrate unequivocally that deep, authentic localization, extending across product, marketing, operations, and management, is non-negotiable for penetrating and sustaining presence in diverse international markets.63 Perhaps most critically in the current climate, the ability to anticipate, assess, and strategically navigate geopolitical risks and abrupt policy shifts, such as the recent tariff escalations, has become a paramount determinant of survival and success.20 Excelling in this new era requires blending operational excellence with acute geopolitical and cross-cultural intelligence.20

B. Strategic Recommendations for Chinese Entrepreneurs Going Global

Based on the analysis of successes, failures, and the current operating environment, Chinese companies aiming for sustained global success should consider the following strategic imperatives:

- Optimize Supply Chain for Resilience, Not Just Cost: The era of prioritizing cost above all else in sourcing is over. Companies must build flexibility and redundancy into their supply chains. This involves strategically diversifying manufacturing footprints (balancing China with other regions like ASEAN, Mexico, or India), cultivating relationships with multiple suppliers, and enhancing transparency to understand underlying geopolitical exposures.18 Integrating geopolitical risk assessments directly into sourcing and investment decisions is crucial.21

- Master Deep Cross-Cultural Adaptation and Localization: Move beyond superficial efforts. Invest significantly in understanding the nuances of target markets—consumer preferences, cultural values, regulatory landscapes, and competitive dynamics.33 Empower local teams with decision-making authority, tailor products and marketing authentically, and consider joint ventures or partnerships to leverage local expertise.73 Building institutional trust through transparency and alignment with local norms should be treated as a strategic asset.95 Avoid the pitfall of assuming a global model will work everywhere without significant adaptation.41

- Embed Geopolitical Risk Management into Strategy: Geopolitical volatility is the new norm. Companies need dedicated capabilities to monitor, analyze, and mitigate these risks.17 This involves utilizing strategic foresight tools like scenario planning and tabletop exercises to anticipate potential disruptions (e.g., conflicts, sanctions, policy shifts) and build contingency plans.21 Understanding the political dimension of strategy and engaging constructively with stakeholders (policymakers, regulators, industry bodies) is essential for navigating complex environments.21

- Double Down on Innovation and Build Global Brand Equity: As cost advantages potentially erode and geopolitical pressures mount, unique value propositions become critical. Continued heavy investment in R&D, focusing on technological leadership and differentiated products, is key to building sustainable competitive advantages.9 Simultaneously, concerted efforts are needed to build global brand recognition and trust, moving beyond a purely product-led approach where appropriate.3 Addressing and overcoming any lingering negative perceptions associated with "Made in China" requires consistent demonstration of quality, innovation, and reliability.52

- Leverage Cultural Strengths Strategically and Adaptively: Chinese entrepreneurs should consciously recognize and utilize their inherent cultural strengths in a global context. Long-term orientation can inform strategic patience and investment horizons.14 Guanxi principles, adapted ethically and appropriately for international settings, can aid in building relationships in complex markets.26 The cultural emphasis on resilience and adaptability should be actively fostered throughout the organization.22 However, application requires adaptation; direct transplantation of domestic practices may not always be effective or appropriate abroad.39

C. Concluding Perspective: The Enduring Dynamism and Future Outlook

The journey of Chinese entrepreneurs onto the global stage is a testament to their remarkable dynamism, resilience, and ambition.24 They have successfully leveraged domestic advantages, particularly sophisticated supply chains, a large pool of skilled talent 9, and unique cultural attributes, to achieve significant international scale and impact. However, the path forward is undeniably more complex and challenging than in previous decades. The rise of protectionism, exemplified by the stringent US tariff regime post-April 2025, coupled with broader geopolitical tensions and increasing regulatory scrutiny worldwide, demands a higher level of strategic sophistication.19

Future success will likely belong to those Chinese enterprises that can effectively integrate deep localization, robust geopolitical risk management, and continuous innovation—fueled by significant R&D in areas like AI and semiconductors 101—into their core strategies. The ability to build resilient and diversified supply chains, cultivate genuine trust in international markets, and adapt nimbly to a constantly shifting global landscape will be paramount. While the "easy wins" of globalization may be receding, the inherent drive, adaptability, and long-term perspective characteristic of many Chinese entrepreneurs suggest they will continue to be formidable players on the world stage. Their "dance through the fire" 48 of global competition and geopolitical headwinds is set to continue, reshaping industries and trade patterns for years to come.